Does a Will Override a Trust?

Most estate plans include a last will and testament, a trust, or both. But if there is a conflict between a will and a trust, which legal document takes precedence? Does a will override a trust in California? Here is an overview of a will versus a trust and which document takes precedence under California law.

What is a Will?

A will is a basic estate planning document that outlines your last wishes. This document lets you name an executor- a person who is responsible for carrying out your wishes. If you have minor children, your will allows you to name a guardian for them. Your will also lets you name beneficiaries for your assets at the time of your death.

In California, if you only create a will, your estate will most likely need to pass through a Probate Court- supervised proceeding before your heirs can receive their inheritance. The probate process is expensive and time-consuming. Many Californians create an estate plan that includes a revocable living trust to avoid a public probate proceeding.

What is a Trust?

A trust is a legal entity in which a party known as a grantor (or settlor) gives another party, the trustee, the right to hold title to and manage property or assets for the benefit of a third party, the beneficiary. Trusts are helpful estate planning tools for avoiding probate. The most popular and common type of trust used in estate planning is a revocable living trust.

A revocable living trust is a trust created while a person is still alive, which can be altered or revoked by the creator at any time during their lifetime. After the grantor dies, the trust becomes irrevocable. The successor trustee then steps in to administer the trust and distribute the trust assets to the beneficiaries.

People who create a revocable living trust also need a will in their estate plan. But they would use a “pour-over” will, which simply pours all of their assets into their trust. Upon the death of the settlor, the successor trustee must lodge the will with the Probate Court. The pour-over will informs the court that the decedent had a trust which will privately administer their estate, so the court does not need to get involved.

Which Takes Precedence: Will or Trust?

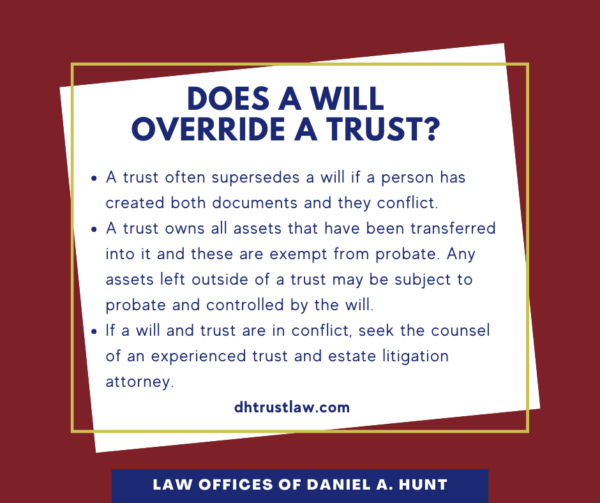

In California, a trust often supersedes a will if a person has created both documents. A trust takes effect immediately, while the trustee is still alive, whereas a will only takes effect after the death of the executor. The trust is a separate legal entity that owns all assets that have been transferred into it. These would be considered trust assets and not estate assets.

After the death of the trust settlor, the will would only control any assets that were left outside of the trust. For example, if the decedent refinanced their home, the house title may have been taken out of the trust to complete the refinance. If the settlor forgot to transfer the real estate title back into their trust once the refinance was complete, that real property may be subject to probate after their death and controlled by the will.

However, if the successor trustee can prove that the decedent was in the process of transferring assets to a trust when they died, or show evidence that they intended those assets to be included in their trust, the trust may still override the will.

When to use a Will Versus a Trust

In California, virtually all homeowners should create a revocable living trust, because owning real property in California will almost always push your assets over the probate threshold. If your total assets are worth more than $184,500 in California in 2023, or if you own real estate worth more than $61,500, you should consult with an estate planning attorney about creating a trust-based estate plan.

However, for very small estates, a will-based estate plan may be appropriate. If your assets are worth less than $184,500 in California in 2023, or you own real estate worth less than $61,500, you may wish to contact an estate planning attorney about creating a will-based estate plan.

If you previously created a will and then create a new trust-based estate plan, the trust (and new pour-over will) replace your existing estate plan. If you previously had a trust but your estate has decreased in size and you now want to create a will-based estate plan, you would need to revoke the trust and create a new will.

Resolving Conflicts Between Will and Trust

Sometimes a will and trust are in conflict, which leads to family members contesting the trust or will. For example, maybe a beneficiary stands to inherit more assets in one document than the other. In cases such as these, parties should seek counsel from an experienced trust and estate litigation attorney for help resolving the conflict.

If you have any other questions about wills versus trusts in California, feel free to contact our law firm.

Law Offices of Daniel A. Hunt

The Law Offices of Daniel A. Hunt is a California law firm specializing in Estate Planning; Trust Administration & Litigation; Probate; and Conservatorships. We've helped over 10,000 clients find peace of mind. We serve clients throughout the greater Sacramento region and the state of California.